The Smart Money Concept (SMC) trading strategy focuses on identifying market structure and liquidity levels to execute high-probability trades. It emphasizes understanding market bias, supply-demand zones, and order blocks, offering a systematic approach to trading financial markets effectively.

Overview of Smart Money Concept (SMC)

The Smart Money Concept (SMC) is a trading philosophy that focuses on understanding how institutional traders and “smart money” operate in financial markets. It revolves around identifying key market structures, such as supply and demand zones, order blocks, and liquidity levels. SMC emphasizes the importance of recognizing market bias and structure shifts, which are critical for predicting price movements. By analyzing these elements, traders can align their strategies with the actions of institutional players, increasing the likelihood of profitable trades. The concept is not a standalone strategy but rather a framework for interpreting market behavior, making it adaptable to various trading styles and instruments. This approach is widely discussed in trading guides, eBooks, and courses, offering traders a deeper insight into market dynamics and institutional trading practices.

Importance of Understanding Market Structure

Understanding market structure is fundamental to the Smart Money Concept (SMC) trading strategy, as it reveals the underlying dynamics driving price movements. Market structure analysis helps traders identify key levels such as support, resistance, and order blocks, which are often areas where institutional players execute trades. By recognizing these structures, traders can anticipate potential price reactions and make informed decisions. Market structure also provides insights into market bias, helping traders distinguish between bullish and bearish trends. This knowledge is essential for identifying high-probability trading opportunities and avoiding traps set by “smart money.” Without a clear understanding of market structure, traders may struggle to align their strategies with institutional flows, leading to inconsistent results. Thus, mastering market structure is a cornerstone of successful SMC-based trading.

The 5-Step SMC Trading Strategy

The SMC strategy involves identifying market bias, locating supply-demand zones, recognizing structure shifts, targeting liquidity levels, and executing trades precisely. This systematic approach enhances trading accuracy and consistency.

Step 1: Identifying Market Bias

Identifying market bias is the cornerstone of the SMC strategy. It involves determining whether the market is in an uptrend, downtrend, or range-bound condition. Traders analyze price action, momentum indicators, and key support/resistance levels to gauge the prevailing sentiment. Understanding market bias helps traders align their strategies with the dominant market direction, increasing the likelihood of profitable trades. This step is crucial as it sets the foundation for subsequent steps, such as locating supply and demand zones and recognizing structure shifts. By accurately identifying market bias, traders can better anticipate potential price movements and make informed decisions.

Step 2: Locating Supply and Demand Zones

Locating supply and demand zones is a critical step in the SMC trading strategy. These zones represent areas where significant buying or selling interest is present, often leading to price reversals or pauses. Traders identify these zones by analyzing historical price action, focusing on areas where price has repeatedly bounced or broken out. Supply zones are typically areas of resistance, while demand zones act as support. By mapping these zones, traders can anticipate where price may encounter liquidity and potential turning points. This step requires a deep understanding of market structure and order flow, as outlined in various SMC trading strategy PDF guides, to accurately pinpoint these key levels and use them for trade execution.

Step 3: Recognizing Market Structure Shifts

Recognizing market structure shifts is essential in the SMC trading strategy. These shifts occur when the market transitions between accumulation, distribution, or equilibrium phases. Traders identify such shifts by analyzing order blocks, liquidity sweeps, and changes in price action. A shift often signals a change in market sentiment, which can be exploited for profitable trades. For example, a transition from accumulation to an uptrend indicates strong buying interest, while a shift from distribution to a downtrend signals selling pressure. By mastering this step, traders can anticipate potential price movements and align their strategies with the market’s direction, increasing the likelihood of successful trades. This step is foundational for understanding the flow of smart money in financial markets.

Step 4: Targeting Liquidity Levels

Targeting liquidity levels is a critical component of the SMC trading strategy. These levels represent areas where large institutions or “smart money” operate, often executing significant orders. By identifying these zones, traders can anticipate where price may encounter resistance or support, allowing for precise entry and exit points. Liquidity levels are typically found near order blocks, supply-demand zones, or areas of previous market structure shifts. Traders use tools like the SMC indicator to locate these levels, as they often act as price magnets. Understanding and targeting these areas helps traders align their strategies with institutional flow, increasing the likelihood of profitable trades. This step emphasizes the importance of patience, waiting for price to reach these key zones before executing trades.

Step 5: Executing Trades with Precision

Executing trades with precision is the final step in the SMC trading strategy, requiring careful planning and discipline. Traders enter positions near identified liquidity levels or order blocks, ensuring alignment with institutional activity. The SMC indicator often highlights these areas, providing clear entry signals. Risk management is crucial, with stop-loss orders placed at safe distances to protect capital. Profit targets are set based on potential price movements, often tied to supply-demand zones or market structure shifts. Traders must remain patient, avoiding impulsive decisions, and stick to their predefined plans. This step emphasizes the importance of consistency and emotional control, ensuring trades are executed with accuracy and confidence. Precision in execution is what separates successful traders from others in the SMC strategy.

Advanced Concepts in SMC Trading

Advanced SMC trading involves mastering order blocks, liquidity sweeps, and market structure shifts. These concepts help traders identify high-probability setups and execute trades with greater precision.

Order Blocks and Liquidity Sweeps

Order blocks are areas where institutions place large orders, creating imbalances in supply and demand. These blocks often signal potential market turning points. Liquidity sweeps occur when professional traders aggressively push prices to fill orders at specific levels, creating opportunities for profitable trades. By identifying these patterns, traders can anticipate significant price movements. Order blocks highlight zones of interest, while liquidity sweeps reveal where smart money is active. Combining these insights allows traders to align their strategies with institutional behavior, increasing the likelihood of successful outcomes. Understanding these concepts is crucial for mastering the SMC trading strategy.

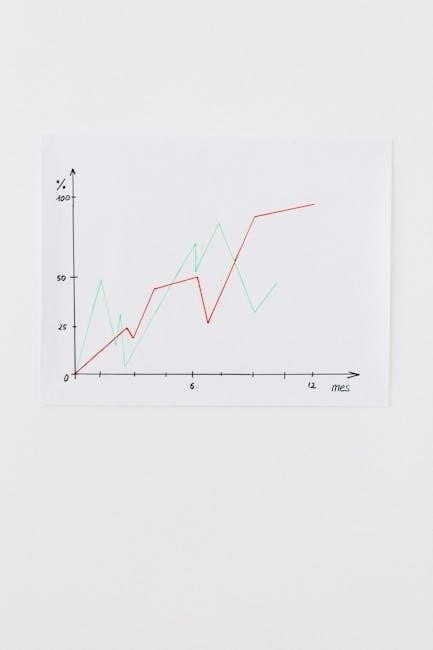

Expansion and Retracement Analysis

Expansion and retracement analysis are critical components of the SMC trading strategy, helping traders identify market structure shifts and high-probability trading opportunities. Expansion occurs when the market breaks out of established supply or demand zones, indicating strong institutional interest. Retracement, conversely, involves price pullbacks after such expansions, often testing key support or resistance levels. By analyzing these phases, traders can pinpoint where smart money is likely to intervene, creating favorable entry or exit points. This approach aligns with the broader SMC framework, emphasizing the importance of understanding market dynamics and institutional behavior to execute precise trades effectively.

Risk Management in SMC Trading

Effective risk management is crucial in SMC trading to protect capital and maximize returns. It involves disciplined position sizing, stop-loss placement, and adherence to predefined strategies.

Position Sizing Strategies

Position sizing is a critical component of SMC trading, ensuring risk management and capital protection. Traders use strategies like Fixed Fraction, where a percentage of the account is risked per trade, or Fixed Ratio, adjusting size as capital grows. These methods help maximize returns while minimizing drawdowns. SMC traders also align position sizing with stop-loss levels to maintain consistency. Proper sizing ensures adherence to risk parameters, preventing overexposure. Resources like the ADVANCED ICT Institutional SMC Trading Book and Udemy courses provide detailed guides for implementing these strategies effectively, ensuring traders can scale their positions wisely while maintaining portfolio health and long-term profitability.

Stop Loss and Take Profit Techniques

Stop-loss and take-profit techniques are essential for managing risk and securing profits in SMC trading. A stop-loss is placed below key support levels or order blocks to limit losses, while take-profit targets are set at logical price levels based on market structure. Traders often use risk-reward ratios to ensure potential rewards outweigh risks. These techniques help maintain discipline and avoid emotional decision-making. By aligning stop-losses with liquidity levels and take-profits with expansion zones, traders can systematically capture market movements. Proper execution of these strategies is crucial for long-term profitability, as outlined in resources like the ADVANCED ICT Institutional SMC Trading Book and related guides, ensuring traders stay consistent and objective in their approach.

SMC Trading Strategy Resources

Discover comprehensive resources like the World Class SMC Indicator PDF and Udemy courses offering detailed guides, video tutorials, and practical examples to master the SMC strategy effectively.

Recommended PDF Guides and eBooks

For traders seeking in-depth knowledge, the World Class SMC Indicator PDF and ADVANCED ICT Institutional SMC Trading Book by David Woods are essential resources. These guides provide detailed insights into market structure, order blocks, and liquidity sweeps, offering practical strategies for identifying high-probability trades. Additionally, Mastering Advanced Trading Strategies: SMC and ICT by Krit Salah-ddine explores sophisticated techniques for combining SMC with institutional concepts. These eBooks are packed with real-world examples, making them invaluable for both novice and experienced traders. They offer a comprehensive understanding of the Smart Money Concept, ensuring traders can apply the strategies effectively in various market conditions. These resources are widely regarded as foundational materials for mastering the SMC trading approach.

Udemy Courses and Video Tutorials

Udemy offers an array of courses and video tutorials dedicated to mastering the Smart Money Concept (SMC) trading strategy. These dynamic resources provide traders with interactive lessons, real-world examples, and hands-on guidance to understand market structure, order blocks, and liquidity levels. Unlike static PDF guides, Udemy courses offer ongoing support and updates, ensuring traders stay informed about the latest strategies and techniques. Courses like the World Class SMC Trading Strategy and Advanced ICT and SMC Trading are highly recommended for both beginners and experienced traders. They cover topics such as identifying market bias, executing trades with precision, and managing risk effectively. These video tutorials are an excellent complement to PDF guides, offering a comprehensive learning experience tailored to different skill levels and learning preferences.

The Smart Money Concept (SMC) trading strategy offers traders a powerful framework to navigate financial markets by focusing on market structure, order blocks, and liquidity levels. By mastering the 5-step strategy and advanced concepts like expansion and retracement analysis, traders can make informed decisions with high-probability outcomes. The availability of resources such as PDF guides, eBooks, and Udemy courses provides comprehensive learning opportunities for traders of all levels. Consistent application of these principles, combined with effective risk management, can lead to long-term success in trading. Whether you’re a novice or an experienced trader, the SMC strategy equips you with the tools to understand market dynamics and execute trades with precision and confidence.

No Responses